“Can a certificate of insurance limit the breadth of protection provided by the insurance policy and endorsements?”

This has to be the weirdest certificate of insurance (COI) question I have ever been asked. Generally, the question goes the other way, asking if language on a COI can broaden coverage.

Technically, the answer is the same regardless of whether the COI language “broadens” or “narrows” coverage – no, the COI does not alter coverage. However, and there is always a “however,” the practical answer can be “yes, the COI does alter the breadth of coverage” IF the holder is harmed due to detrimental reliance on the information contained in the COI.

Somehow, it seems unreasonable to assert that the holder can be harmed by detrimental reliance if wording in the COI narrows the breath of protection. Because detrimental reliance does not seem to be an issue, the answer is back to no, the COI does not affect the breadth of coverage provided by the policy. (Besides, the concept of “detrimental reliance” is for the benefit of the holder.)

Even the disclaimer language contained within the COI supports the idea that coverage is not altered. The COI (ACORD 25) specifically states:

“THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AFFIRMATIVELY OR NEGATIVELY AMEND, EXTEND OR ALTER THE COVERAGE AFFORDED BY THE POLICIES BELOW. THIS CERTIFICATE OF INSURANCE DOES NOT CONSTITUTE A CONTRACT BETWEEN THE ISSUING INSURER(S), AUTHORIZED REPRESENTATIVE OR PRODUCER, AND THE CERTIFICATE HOLDER.”

According to the COI language within the form, coverage is not amended in any way. Seems relatively clear that, short of detrimental reliance, nothing in the COI alters the reality of the policy language.

Back to the initial question, and the reason for this review, “Can a certificate of insurance limit the breadth of protection provided by the insurance policy?” Obviously, the COI cannot narrow the clear policy language any more than it can expand it.

Why, then, is this a question to consider? When the insurance carrier tries to get out of paying a claim because of information contained on the COI.

How absurdly ironic. It is understandable for a carrier to attempt to avoid paying a claim because the COI expands coverage. But it seems incredibly ridiculous (maybe not quite to the level of bad faith, but close) for the insurance carrier to then use the COI to claim that the policy doesn’t respond because the COI narrows the breadth of coverage.

The carrier cannot have it both ways. Either the COI affects coverage or it does not!

Let’s use the Automatic Additional Insured endorsements as an example. For this example, the narrower of the two available ongoing operations automatic additional insured endorsements is used, ISO’s CG 20 33 – Additional Insured-Owners, Lessees or Contractors-Automatic Status When Required in a Written Construction Agreement With You.

This is considered the narrower of the CG 20 33 and CG 20 38 because it requires “privity of contract,” meaning that to be an additional insured, the party must be the contracting party. The CG 20 38 automatically extends AI status to any party requiring such status in the contract, not just the contracting party. (Irrelevant to this article, just for information.)

ISO’s CG 20 33 extends additional insured status to, “any person or organization for whom you are performing operations when you and such person or organization have agreed in writing in a contract or agreement that such person or organization be added as an additional insured on your policy.”

“Any” is a relatively broad term – it means any. The wording extends AI status to “any person or organization” the insured is performing operations when a written contract requires AI status be extended to that contracting party. There is very little doubt of the intent. If the contract requires AI status be extended to the party with privity of contract, AI status is extended.

How could the COI possibly be used to narrow this grant of protection? Many agents are in the habit of listing the relevant project in the Description of Operations; or possibly such listing is required by the contract, but does listing the wrong project in the COI negate the grant of AI status found in the endorsement?

Assume the insured works on many projects for the upper tier contractor, each under separate contracts, and all contracts require AI status. Presently the insured is working three projects:

- Johnson Project at 123 Main Street;

- Smith Project at 321 King Street;

- Jones Project at 456 Meeting Street.

The agent issues a COI for each of the project but forgets to change the project name within the COI’s Description of Operations. Does the listing of the Johnson Project in the COI for the Smith Project change the grant of AI status?

Don’t laugh! This is a real possibility, especially if the loss is large enough.

Let’s answer three questions:

- What does the endorsement require for a party to be an AI? A written contract. As was already stated, each project was under separate contract. But even if all projects were on the same contract, there is still a written contract in place requiring AI status.

- Does the endorsement reference any documents OTHER THAN the written contract? Well, no. The only document referenced in the endorsement is the contract. The COI isn’t contemplated in the application of the endorsement.

- Does the COI alter coverage? Seems this has already been addressed. Technically no, unless the HOLDER is harmed by detrimental reliance.

This leads to the ultimate question, does having the wrong project and/or address affect the extension of AI protection to the upper tier contractor? No!

Certainly no insurance carrier would attempt to use a COI to limit coverage when they are endlessly stating that a COI does NOT expand coverage. This would be the height of irony and an ethical low point.

Was this article valuable?

Here are more articles you may enjoy.

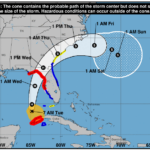

Warren Buffett’s Bet on Mild Florida Storm Season Faces Test With Hurricane Idalia

Warren Buffett’s Bet on Mild Florida Storm Season Faces Test With Hurricane Idalia  Burger King Must Face Lawsuit Claiming its Whoppers Are Too Small

Burger King Must Face Lawsuit Claiming its Whoppers Are Too Small  Montana Brokerage Owner Admits to Defrauding Customers

Montana Brokerage Owner Admits to Defrauding Customers  Citizens Suspends Binding, Could Be Most Affected as Hurricane Aims for Big Bend

Citizens Suspends Binding, Could Be Most Affected as Hurricane Aims for Big Bend