The New Hampshire Insurance Department (NHID) recently approved a workers’ compensation rate proposal that will reduce voluntary loss costs by 14% on average.

The new rates will apply to policies effective starting on January 1, 2024.

According to the insurance department, loss costs in the voluntary workers’ compensation market have decreased in each of the last 12 years, and more than 63% cumulatively over this period. For 2023, voluntary loss costs were reduced 7% on average and for 2022, they were down 8% on average.

The loss cost is the regulated portion of an employer’s insurance premium that pays claims costs for work-related injuries. The loss cost is ultimately used by insurers to set rates and premiums in the voluntary market. All insurers writing voluntary workers’ compensation in New Hampshire are required to use the new loss costs and are then permitted to adjust it for their own company expenses.

“Lower loss costs are indication of safer workplaces and quicker recovery times when injuries do occur,” said Christian Citarella, chief property/casualty actuary for the NHID. “These factors, in conjunction with a continued downward trend in workers’ compensation medical expenses, have resulted in lower insurance rates for employers.”

“There is a very strong market for workers’ compensation products right now, enabling business owners to shop around with multiple carriers for the best deal on workers’ compensation insurance,” said NHID Deputy Commissioner DJ Bettencourt. “Continued stability in this market benefits both business owners and employees across the Granite State.”

NCCI

The rate proposal was filed in July by the National Council on Compensation Insurance (NCCI) which prepares workers’ compensation rate filings for insurers writing in the state. The filing was based on premium and loss experience as of year‐end 2022 from policy years 2019, 2020, and 2021 and showed improved experience.

NCCI also filed a 2024 rate proposal for the involuntary or assigned risk market that handles risks that cannot find coverage in the voluntary market. That filing calls for a –14.5% decrease in the assigned risk market for 2024.

In its filings to the NHID, the rating organization noted that the workers’ compensation system remains healthy across the country with wages, premiums, and indemnity benefits mostly in balance. NCCI did add that on a countrywide basis, there was a rise in claim costs for 2022, with medical claim costs increasing about 5% and indemnity claim costs rising about 6% year over year.

Private workers’ compensation carriers posted a calendar year countrywide combined ratio of 84% (below 100% indicates underwriting profitability), which was the sixth consecutive year they achieved a combined ratio below 90% and the ninth consecutive year of underwriting profitability, NCCI reported.

Topics Workers' Compensation Talent

Was this article valuable?

Here are more articles you may enjoy.

Home Insurance as a Work Benefit? Recoop Says It’s Bringing it to Florida and All States

Home Insurance as a Work Benefit? Recoop Says It’s Bringing it to Florida and All States  US Corn Harvest Is in Trouble

US Corn Harvest Is in Trouble  2023 to Test Recent Growth in Private Flood Insurance Market

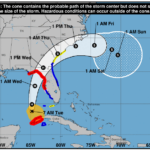

2023 to Test Recent Growth in Private Flood Insurance Market  Citizens Suspends Binding, Could Be Most Affected as Hurricane Aims for Big Bend

Citizens Suspends Binding, Could Be Most Affected as Hurricane Aims for Big Bend