How to Upload and Manage Google Business Profile Videos

We all know that adding pictures to anything on the web grabs a person’s attention and increases engagement. The same goes with your Google Business Profile (formerly known as Google My Business). Google openly tells you adding pictures and posts to your Google Business Profile helps give visitors visual information about your company—and who doesn’t love that? In fact, according to Google, businesses with recent photos typically receive more clicks to their websites.

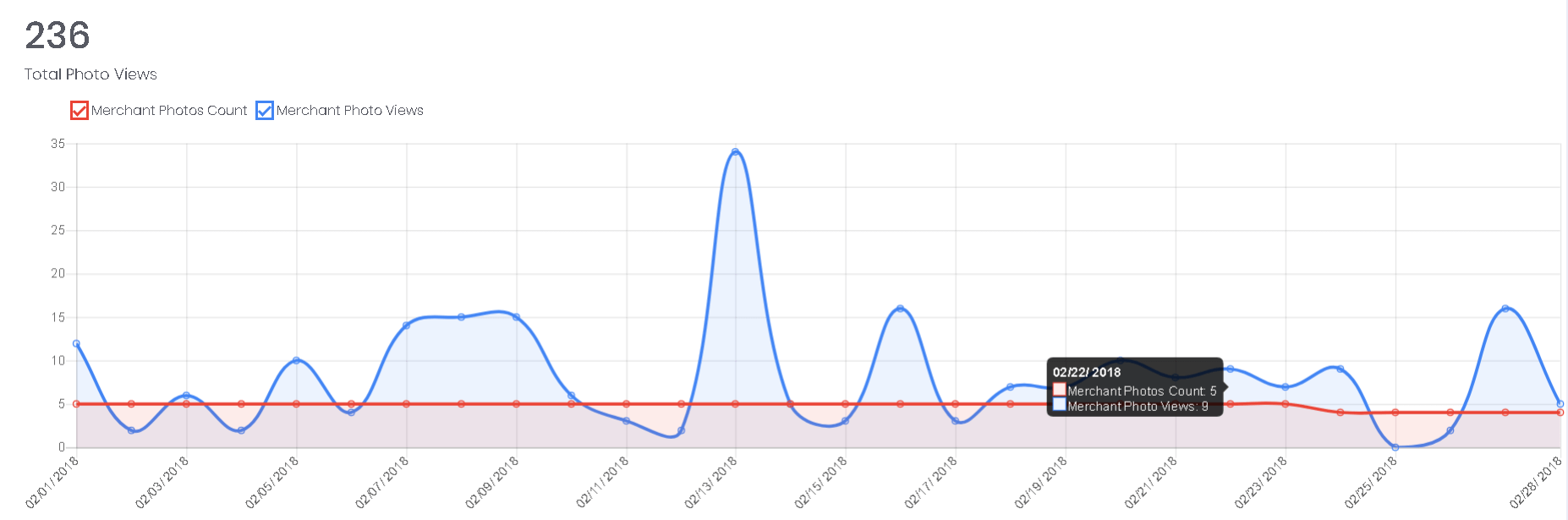

Photos also help engage the people that see your Google Business Profile—and Google tracks every interaction that people have with your listing. The more interactions, the more important Google feels your business is. Below you can see just how many times people have seen an attorney’s photos over just a one-month time period. Her GBP photos were viewed 236 times!

Now, if there’s one thing that’s better than photos, it’s video. In fact, video is so engaging that you don’t even need sound. Studies show that as much as 85% of Facebook video is viewed with the sound off. Surprised? You shouldn’t be. Just the movement of a video is enough to stop a person as they’re scrolling on a page.

The problem: most business owners think that videos have to be big productions and therefore too much for them to tackle. Relax. Making a video doesn’t have to be difficult. Here’s why: you can now create a 30-second video that will grab people’s attention on one of the most popular places people go to search for and find information: Google!

Yes. Recently Google announced that they added video capabilities to Google Business Profile! In addition to adding photos to your Google Business Profile, you can now add videos that show off cool things about your company. Have you taken advantage of adding a video about your business? If not, it’s time to get started…

How to Upload Google Business Profile Videos

Google Business Profile allows videos up to 30 seconds long, and these videos can be added by customers and by owners. As a manager of a Google Business Profile account, you should first login to your GBP account.

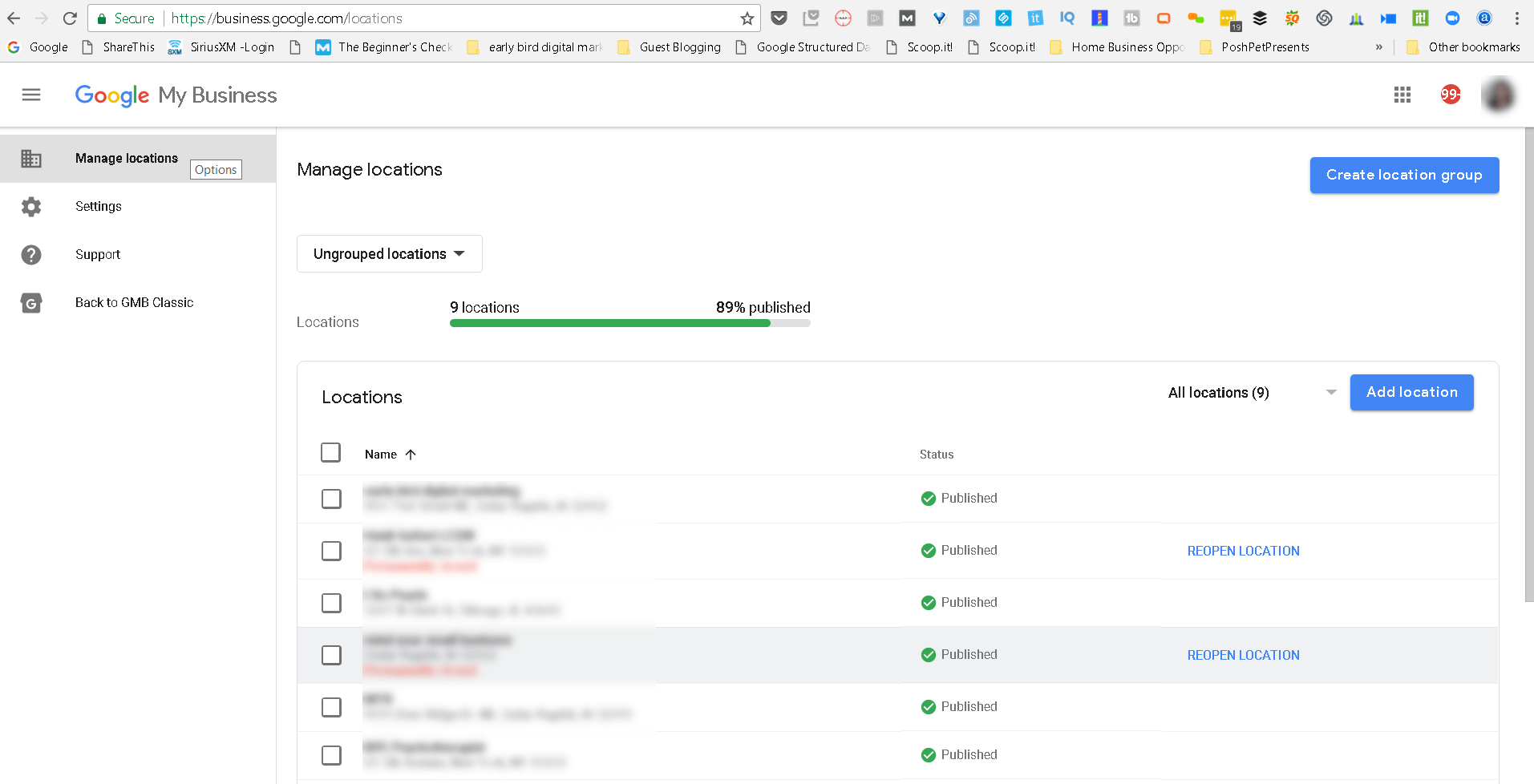

In the dashboard you will see all the locations you currently manage:

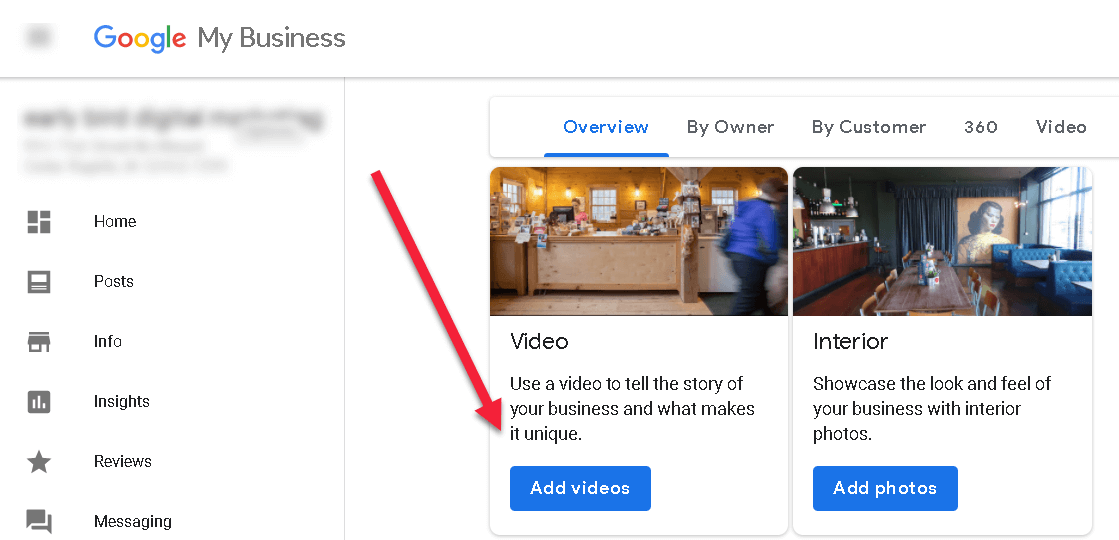

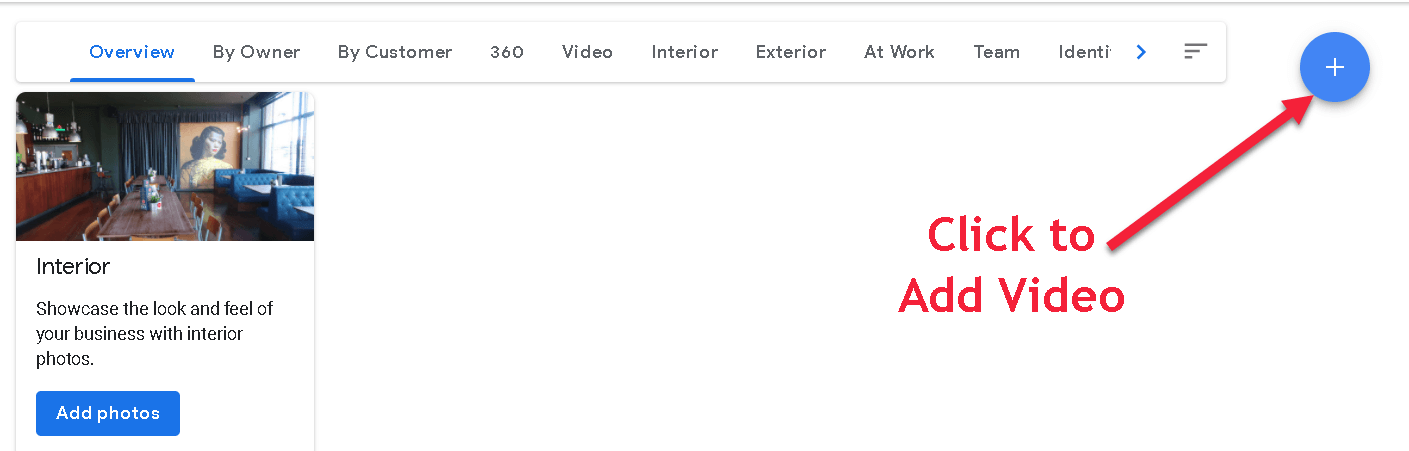

Click on the business location you’d like to add your video to. You will either see the ‘Add Videos’ image on the Overview tab…

…or you can also click on the blue + sign to add a video:

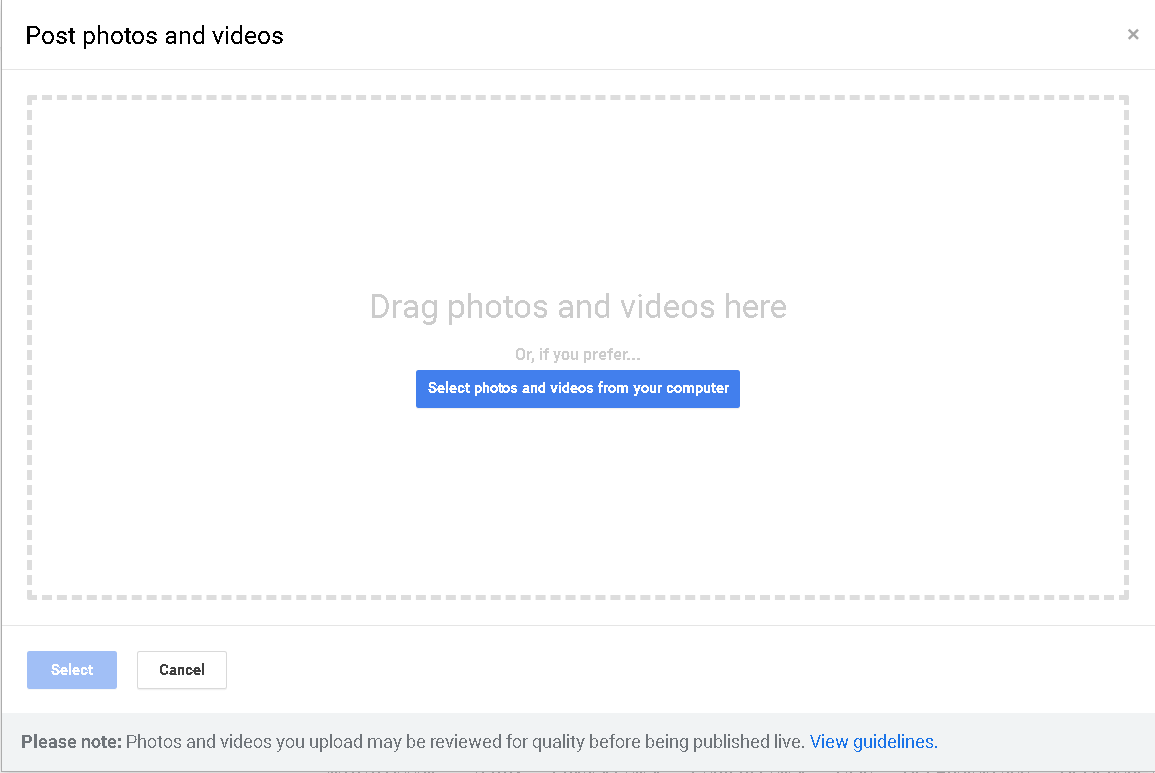

Once you click on the ‘Add Video’ button you will be given the option to drag the video you want to upload or select the video from your computer—making it super simple.

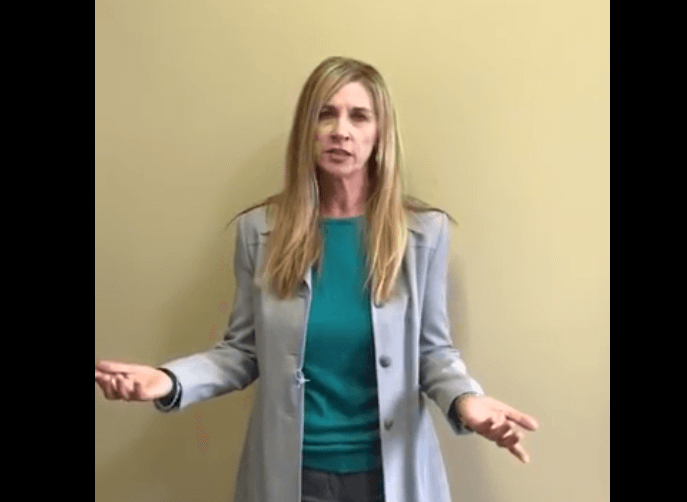

Google says that once you upload your video it can take up to 24 hours for it to display, but our videos have loaded in minutes—which is fantastic! (In this video example the attorney gave some tips on how to handle a dissolution of marriage—very useful if you’re going through a divorce and are trying to understand what the divorce “lingo” means.)

However, for you marketers out there—there’s a catch. You need to make sure your videos are taken at the place of business, are of people that work at your business or directly pertain to your business. (Google Business Profile videos is no place for cheesy stock photos, stock videos or marketing bling videos.)

In fact, Google can remove them if the primary subject of the content is not related to the business location. (And people are tired of seeing stock photos anyway. Google Business Profile is a way to show off the people, personality, culture, products and services of your business (not the sanitary version of a stock photo business.) So that means no stock photos or stock videos!

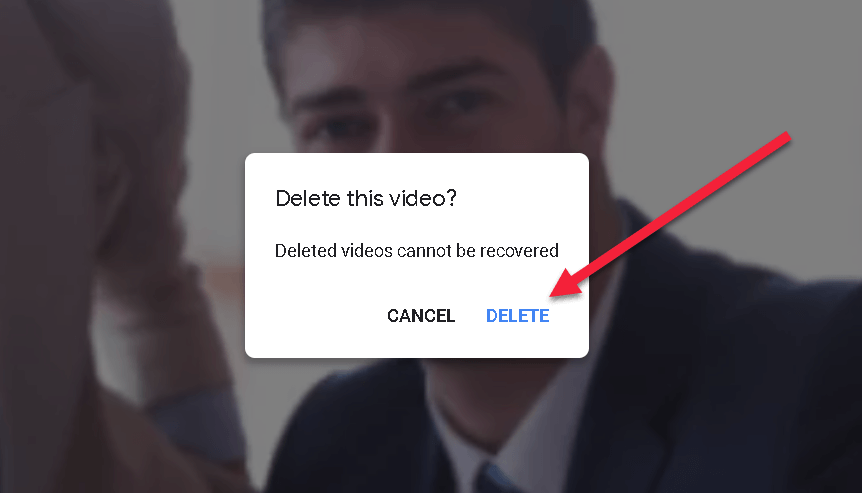

If you decide you don’t like the video you added, it’s simple to delete by clicking on the trash can icon and then hitting ‘Delete’.

Once you upload the videos to your Google Business Profile account, they will appear in the overview tab on the Google Business Profile Dashboard. Owners who uploaded videos can be seen in the ‘by owner’ tab. When customers upload videos they will appear in the ‘customer’ tab. All videos will be displayed in the ‘video’ tab.

![]()

Once uploaded to Google Business Profile, your videos will display where your local photos do. As a bonus: if you have two or more videos, you can get a video subtab that will show up on mobile devices.

What Size, Duration and Resolution Should Google Business Profile Videos Be?

Google has given us general guidelines for the GBP videos. Keep in mind that if your business isn’t verified yet, your videos won’t show up as live until you verify your GBP listing.

If your business is verified, you’re ready to upload videos! After you’ve decided what video you want to upload to your Google Business Profile, make sure the video follows these guidelines when it comes to the video size, length and resolution:

- Google Business Profile Video Max Duration: 30 seconds

- Google Business Profile Video Max File size: 75 MB (reduced from 100 MB as of October 2020)

- Google Business Profile Video Min Resolution: 720p

(Note: We were able to upload a video that was 1 minute 30 seconds long, but that may have been a fluke.)

What Kind of Google Business Profile Videos Should You Create?

Many people get hung up on the type of videos to create—when really, that’s the easiest part!

Here are some GBP video ideas (and remember—you only have to make 30-second videos*, so keep them short and to the point):

- Show how one of your products is packaged and shipped out

- Highlight and show off an employee

- Give a tour of your office

- Create a company “mascot” (like a bobble head) and every day you can have a “find the mascot” search throughout your building

- Have your customers “sit in” on a company meeting so they see how decisions are being made

- Having a company picnic? Bring the camera along and share the fun

- Feature how a product is made

- Interview employees about what they like best about working for your company

- Invite your customers to upload videos to your GBP listing

*Google has stated that the videos should be 30 seconds in length, but we were successfully able to load a very informative one minute thirty second video to a client’s Google Business Profile Account. But remember video marketing best practices—don’t make your videos so long that you lose your key audience.

The best strategy for the videos is to sit down with your team and brainstorm about the types of videos you can create and upload—and then… just do it!

What About Inappropriate Videos Customers Might Upload?

Many business owners are concerned that customers/clients can change information and add videos and pictures to their Google Business Profiles. (And sometimes they should be concerned—all it takes is one inappropriate video and the damage is done.)

If you’re a business owner or manager of a Google Business Profile Page, you can flag inappropriate videos through your dashboard. If the inappropriate video is not removed by Google, jump onto the Google Business Profile Forum and see if you can politely ask for a Google Business Profile Top Contributor’s help.

To see the guidelines for submitting user-generated content, you can see Google Maps User Contributed Content criteria.

More to Come

Google has been making a lot of great updates to Google Business Profile over the last few months. According to Google, native mobile support and notifications of new customer videos are coming soon. And you can bet there are even more cool things coming ahead!